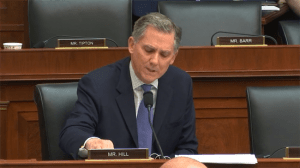

U.S. Rep. French Hill (R-AR) urged the U.S. Small Business Administration (SBA) to work with the Internal Revenue Service (IRS) to resolve an issue impacting business owners in central Arkansas.

Specifically, the business owners are having an “ongoing issue” with the SBA’s Economic Injury Disaster Loan (EIDL) program, according to a Sept. 13 letter that Rep. Hill sent to SBA Administrator Isabella Guzman and copied to IRS Commissioner Charles Rettig.

“My office has received requests for assistance from several small businesses that are receiving denial letters from the SBA on their EIDL program applications due to unverifiable information,” wrote Rep. Hill, who cited a recent conversation with the Arkansas SBA that indicated a disconnect exists between the IRS and the SBA in determining the correct documents needed for business owners to receive the EIDL.

Additionally, the problem is “further exacerbated” by an IRS delay in providing Form 4506-T to the SBA. The form gets filled out by the applying business owner and is submitted to the IRS to request a transcript of the business’ tax return, which is then sent directly to the SBA, according to the congressman’s letter.

“There is a severe disconnect in communication between the two agencies which derails the EIDL process and causes unnecessary hang-ups in issuing much needed funds to small businesses,” Rep. Hill wrote.

As businesses across the country continue to struggle with the negative impacts of the ongoing COVID-19 pandemic, Rep. Hill wrote that it is important for small businesses to qualify for financial relief from programs like EIDL.

“I implore you to work with the IRS to ensure this miscommunication gets resolved so that Arkansas’s small businesses can benefit from SBA’s EIDL program,” wrote the lawmaker.