A just-released bill from U.S. Rep. Jim Renacci (R-OH) would establish a new online portal at the Internal Revenue Service (IRS) allowing American businesses to electronically submit Form 1099, a proposal that could curb tax fraud and provide tax administrators access to real-time data.

“As a CPA, removing the chance of error is vital,” said Rep. Renacci, a senior member of the U.S. House Ways and Means Subcommittee on Tax Policy. “We have to give the IRS the tools it needs to keep up with the times. Utilizing this technology will help the agency in its goal of being efficient and effective.”

Rep. Renacci on March 21 introduced the Creating an Online Platform for Instant 1099 Submissions Act, H.R. 5377, with original cosponsors U.S. Reps. Diane Black (R-TN) and Mike Bishop (R-MI).

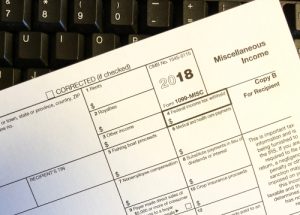

H.R. 5377 would direct the U.S. Secretary of the Treasury to oversee creation of the internet platform for the electronic transfer of Form 1099, which companies use to report payments to non-employee workers, such as independent contractors. The U.S. Social Security Administration (SSA) currently offers an online portal for businesses to submit W-2s documenting wages paid to employees, and SSA shares the information with the IRS, but no online portal exists to submit 1099s, according to the congressman’s staff.

If enacted, the free online 1099 portal developed under Renacci’s proposal could reduce incidences of identity theft and tax fraud because the IRS would have more time to review the faster-filed electronic 1099s and cross reference them with data from the corresponding individual returns, his staff said.

Additionally, H.R. 5377 would set a Jan. 1, 2020 deadline for completion of the online 1099 portal so that it could be ready for the 2020 tax filing season.

H.R. 5377 has been referred to the U.S. House Ways and Means Committee.